Today’s note will be short and sweet, but I wanted to pass it along as it is both relevant and timely given the piece I wrote last night.

It’s only been a mere ~12 hours since I published Flash Point: Price Drives Sentiment and I’ve already come across two separate instances that hearkened back to what I discussed last night. One instance is more important than the other, but who am I to be the gatekeeper of a good story?

Before I continue: If you haven’t had a chance to read the piece from last night, you should check it out - it’ll clarify what I talk about here. Link below:

Life has a funny way of connecting seemingly unrelated moments and tying them together in unexpected ways.

Around 6am this morning, I threw CNBC on the tv with closed captions on so I could listen to Spotify over the Sonos. Having just written about my days at Penn State, I was feeling a bit nostalgic so I decided to listen to my Lehman Brothers Elevator Oldies playlist, which was a staple in our apartment for years. I hit shuffle and out came the sweet sounds of “End of the Night” by the Dropkick Murphys - a song my roommate, now successful Labor Union lawyer, declared as “Tom Hogan’s musical biography.”

Those days may be behind me, but at least I can say I understand how Gator feels! “There’s a darkness inside of me… it wants some walking around money. It wants to buy some shoes and it wants to walk up with the people and say, “Hey, Gator don’t play no shit! You feel me? Gator nevah been ‘bout that!”

Throwing Caution to the Wind

After a few minutes passed, I turned the sound up on CNBC to listen to a Financial Advisor talk about where she’s allocating client capital, general sentiment amongst her clients, etcetera.

Note: Apologies for the overuse of the word “she” - I purposely excluded her and her firm’s name out of professional courtesy.

She went on to explain that her biggest issue is trying to get clients to put their cash to work in equities. She also noted that the average yield on client cash is roughly 5% (!), but she was resolute when articulating how cash is a “stale” position relative to equities.

The final question she was asked was, ”How are you presenting the opportunity in equities relative to cash to your clients?”

Her response? Equities will outperform cash over the next 12 months and from a fundamental standpoint equities are ‘cheap’. Her strategy for achieving this? Buying on pullbacks.

Alright. I could write a graduate degree thesis on how everything she said is wrong, but that’s not the point. The point is how she believed her thought process to be one of fact, not opinion. Ringing any bells? Bueller?

The S&P 500 at a Glance

Again, rather than dismantling what she said, I have provided charts from Yardeni Research, which you can also look at. They do a phenomenal job at presenting charts in a digestible format, but the best part is that it’s completely free.

S&P 500 Forward P/E: In normal market conditions I would view her adamant stance towards stock as greedy, but I don’t think it’s that. She’s a very smart investor, but even the best investors can get swept up in the throws of euphoria and FOMO.

It doesn’t take a CFA designation to look at the charts of the Forward P/E multiple on the S&P 500 to see that there is nothing cheap about it.

Stock Selection: I also don’t want to hear, “but Tom, the largest stocks in Spooz are pulling the average P/E multiple higher! My stocks are fine!”

The first part of that statement is correct… and it’s also an exhausted point that all of the talking heads make. Have you considered the fact that passive dollars into the index compared to active dollars is so heavily weighted towards passive that every dollar in or out doesn’t mean a damn for your 10 Forward P/E individual equity position? Passive flows are position agnostic, it’s simple dollars-in, dollars-out.

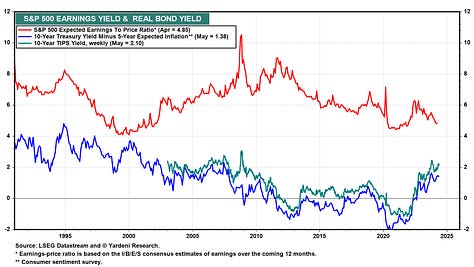

Equity Risk Premium (ERP): Put simply, the ERP is the additional return that investing in equities provides investors over the ‘risk-free rate’ aka government bonds.

ERP is 3.37% or the lowest since Q2 2002 - 22 years ago! Please, someone make it stop. Cash at 5% is ‘stale’ position, but taking on equity risk with ERP running 337bps is smart? No, that’s reckless risk-management.

Have We Lost Our Minds?

She’s a damn fiduciary, not a hedge fund manager. She’s not alone either, but 15+ years of moral hazard from the Fed has protected advisors like this. The fact that I even need to state this bothers the hell out of me, but for my own sanity I will:

These advisors are responsible for everyday peoples’ money. There are very few that run Private Wealth Management teams with clients who don’t bat at an eyelash when they want to buy a private jet. Advisors like the one on CNBC this morning are putting hard working peoples’ money at risk and for what? To make a name themselves? Give me a break

I hope it doesn’t, but if things go sideways, you’ll hear CNBC and Bloomberg - the same channels hosting these guests - saying, “How did this happen?”. I don’t need to tell you how or why it happened, you, the news networks, helped aid this type of behavior. I can’t put the blame on them specifically as they are just a symptom of the disease, which is the Fed, but for today, I digress.

Ring The Bell

This will probably sound backwards after that little rant I had there, but I’m in a great mood. I get worked up when I feel like hard working people are having their capital put at risk beyond the normal risk taken in any market.

Remember what Twain said, what you think you know is not fact, it is opinion. Be proactive, not reactive.

Rather than having an aneurysm thinking about some of the malfeasance out there, I’m off to ring the bell. I’m heading down to Citizens Bank Park with Cousin Matthew to enjoy a few Yuenglings and hot dogs while watching the Phillies take on the Texas Rangers. Nothing can stop that happiness, I can tell you that much.

Flash Point Part 2 will be published tomorrow. Go Phils, baby!