Making the Case for Enovix (ENVX)

Wellll laaaadiiii frickin’ da! We got ourselves a writer here!

“It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena.” - Theodore Roosevelt

Life has a funny way of coming full circle. It’s been years since I worked in Equity Research professionally, but boy oh boy, how I have missed digging in and dissecting companies. There’s something about becoming the man in the arena once you put your work out there, and having the market tell you in no uncertain terms if you’re right or if you’re a half-brained moron. Markets are black and white: either you’re right or you’re wrong, and you can’t hide from your performance. But that’s why we do it, right? Put up or shut up.

In a previous piece, I mentioned that I would be putting out individual stock research for both long and short positions. Now that I have started getting my feet under me, I expect to publish content 3-5 times a week across various topics. Although it will not always be research reports, my long-form research is where I hope to create the most value for readers. With that being said, my research will be available to all subscribers for the time being, but there will come a day in the (somewhat) near future where my long-form writing and research pieces will be behind the paywall.

As the greatest motivational speaker of our generation, once said,

“Wellll laaaadiiii frickin’ da! We got ourselves a writer here! Hey Dad, I can’t see real good - Is that Bill Shakespeare over there?” - Chris Farley as Matt Foley, Saturday Night Live (1993)

I can’t promise that I’ll be as good as ole Billy Shakespeare, but I can promise that I won’t live in a van down by the river if I can encourage you all to subscribe to the paid version of Hoags Research. I am truly grateful for you all being the first 100+ subscribers in such a short period of time. As a result, I wanted to show my appreciation, which is why I have opened a 50% lifetime discount for both monthly and annual subscriptions. The discount will be available for the next few weeks, but if you miss it, please don’t hesitate to reach out. Over time, I expect to increase the subscription price, but your subscription price will not change from the current discounted price. Additionally, I have set up a referral program where if you share my pieces with others and they subscribe, you will receive months, and even annual subscriptions, entirely free depending on how many people subscribe from your sharing. I want to thank you all again for being the first readers of Hoags Research, and I look forward to continuously improving and delivering value. With that, I will put my change cup away, get off my soapbox, and get to the good stuff.

Key Statistics

Price: $7.76/Share

Market Cap: $1.31bn

Enterprise Value: $1.20bn

*Price data as of the cash close on Thursday (3/14/2023)

**Company financials as of 12/31/2023, as stated in ENVX 10-K

Summary

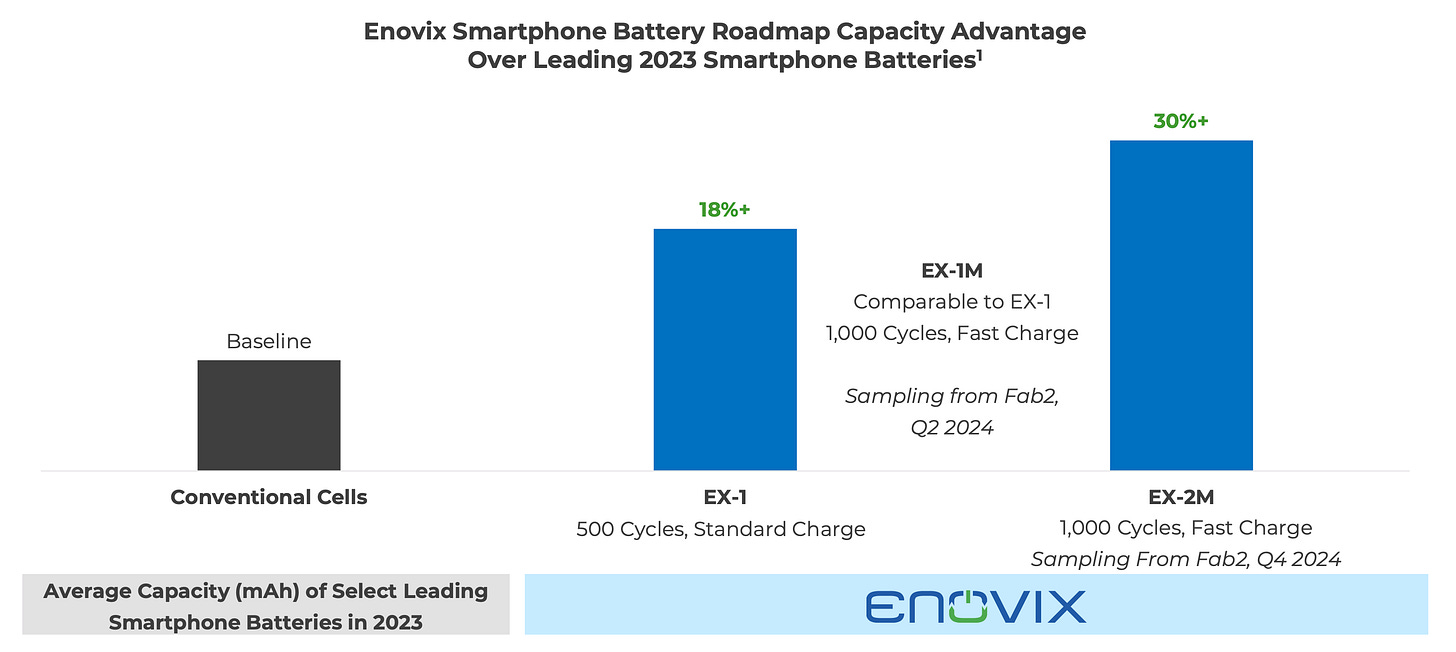

Enovix (ENVX) continues to beat analyst estimates through exceptional operational efficiency. As the company maintains guidance heading into FY 2025, I believe Enovix will continue to de-risk by increasing its production ramp and addressing end-market demand constraints. This de-risking process is expected to continue as equipment testing at the Malaysia-based Fab-2 facility progresses in a timely manner. Furthermore, Fab-2 production is anticipated to begin production in the second half of 2024, with initial factory yields of approximately 60% once production starts, before ramping to ~90% in the second half of 2025. Once production starts at the Fab-2 facility, the company will be able to increase the pace of Fab-1 repurposing while also improving input costs. Additionally, Enovix continues to experience growth in its testing pipeline with the inclusion of more auto OEM test cases. The ongoing tests with OEMs, coupled with the company’s existing contracts, underscores the strong market demand for Enovix products across various sectors.

Reasons I am bullish:

Superior management team and Board of Directors.

Cutting-edge technology with differentiating factors that have created a multi-year competitive advantage over peers and significant market demand for Enovix products.

Asymmetric risk-reward profile, given market dynamics and company valuation

My perspective on ENVX is distinct from other investments I consider because I view ENVX as a long-term investment, one I can feasibly see holding for 5+ years barring significant shifts in operational efficiency and/or poor capital allocation by management. It’s challenging to find opportunities that present a risk-reward profile that is as favorable as ENVX’s. Having followed the company since it went public via SPAC in July 2021, I am confident in my analysis and believe that ENVX will be a cornerstone of my portfolio for the foreseeable future. As a mid-cap company, I anticipate price volatility, but I also welcome it, as volatility will allow me to add to my position when the stock sells off.

Overview

Enovix Corporation (ENVX) is a pioneer in the field of lithium-ion battery technology. Founded in 2007 and based in Fremont, California, Enovix is at the forefront of designing, developing, and manufacturing their trademarked 3D Silicon-Anode Lithium-ion batteries. Put more simply, Enovix has spent almost two decades researching and developing proprietary lithium-ion (“Li-ion”) batteries that have significantly more energy density and useful capacity than competitors’ lithium-ion batteries.

I can hear it now, “Tom, why should I give a damn about lithium-ion battery technology? This isn’t exciting at all.” Here’s an example that we can all relate to so you can start getting excited about what Enovix has created:

You know how your iPhone battery life degrades after a few years, leaving you with a phone that quickly loses juice after only a few hours, no matter how meticulous you are about closing apps and minimizing the display light? The reason this happens is because the Li-ion batteries that Apple (and every other major OEM) currently uses in their products, from the Apple Watch to iPhones to MacBooks, all “burn out” over time. I’m oversimplifying the step functions in a Li-ion battery’s lifecycle, but essentially, batteries have ‘cycle’ capacities, which refers to the number of times a battery can go from fully charged to completely dead. As a battery goes through more cycles, the max power the battery provides the device becomes lesser and lesser. Once a battery can no longer reach 80% of its max capacity, the battery is considered to be no longer functional. I have included a great visual that shows the difference between Enovix’s battery life after 500 and 1,000 cycles compared to that of the top-9 smartphone OEMs:

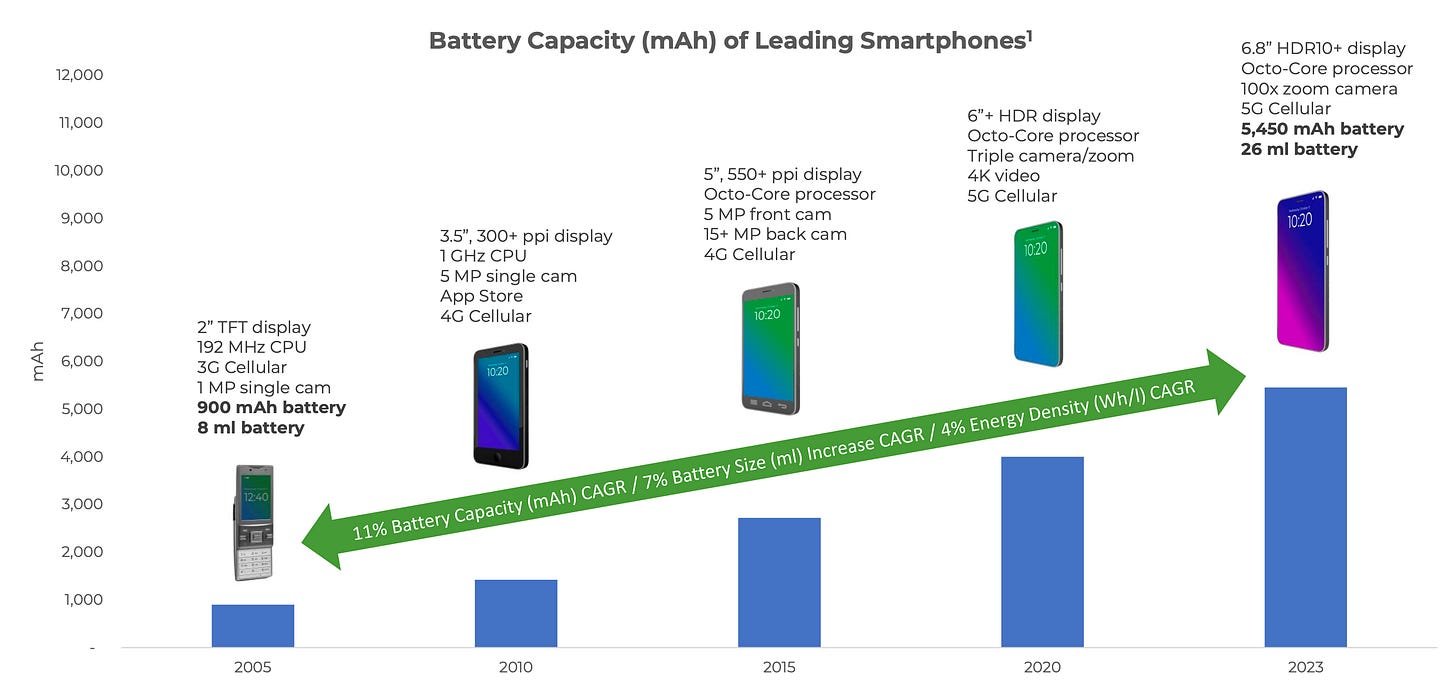

Although our batteries last longer today, the primary reason for that improvement has been driven almost solely by the increase in size of the batteries rather than more efficient technology. OEMs have been able to get away without improving technology because batteries have been able to become larger as the size of our consumer products have also gotten larger.

The chart below shows that since 2005, the Compound Annual Growth Rate (“CAGR”) of smartphone battery capacity – a battery’s “total power” – has increased 11% Annually, but 7% of that 11% CAGR can be attributed to the size of the battery, while only 4% can be attributed to battery density – how much total power a battery holds.

As mentioned previously, OEMs have been able to evade allocating capital to R&D for battery technology for two primary reasons:

First, consumer products have continued to increase in size over the last 15 years, which has allowed the OEMs to increase the size of batteries. The larger the battery = the longer the battery lasts.

Second, OEMs have improved mechanical efficiencies of the other components that make up a smartphone and other consumer products. These improvements also include minimizing the space the other components utilize, which frees up additional space for a battery.

Again, these are oversimplifications of the advancements in battery tech, but as you can see from the chart above, energy density increasing by only 4% while battery size has grown 7% proves my point: OEMs have avoided spending R&D dollars on tech and have spent that capital elsewhere, which has served them well until now.

Understanding Enovix’s Competitive Edge

Since its inception in 2007, Enovix’s Founders and management team have been dedicated to fundamentally altering battery performance, a goal that necessitated a reinvention of Lithium-ion battery architecture. From its earliest days, the people inside Enovix company walls knew they would need to take an unconventional approach to designing and manufacturing if they wanted to alter battery technology at its core. Fast forward 17 years and Enovix has done just that - Now the company has begun to reap what it has sewn with by beginning to manufacture their proprietary 3D battery tech across different consumer product sets including Wearables, IoT, Computing and Electric Vehicles.

It’s easy to overlook the importance of patents and Intellectual Property (IP), but when it comes to technology ubiquitous in households worldwide, these assets are critical for maintaining competitive advantages. As of December 31st, 2023, Enovix held approximately 50 issued US patents and 160 issued foreign patents, along with 30 additional patents pending in the US and another 160 patents pending in foreign countries.

With its innovative active silicon anode 3D lithium-ion batteries, Enovix is poised to become a leader in powering modern technologies.

The Market Problem

In order to understand the market problem, we have to look back to the first use of Li-ion batteries in consumer products. In 1991, a little unknown company named Sony used a lithium-ion battery to power their newly invented handheld video camera. The use of the Li-ion battery in this capacity was a technological breakthrough at the time, but the advancements in Li-ion battery technology since its first use have been made in the components surrounding the batteries, not the actual battery itself, for the most part. It is my belief that the lack of R&D investment into the battery technology itself is a result of complacency rather than one of negligence, but I could also make a strong case that it was negligence - “Tomayto-Tomahto” I suppose.

The reality OEMs are now facing cannot be resolved in a short period of time, which in corporate terms means OEM management teams are facing an “Oh, shit” moment. Rather than working proactively from a place of leverage, OEMs now have to find the “least bad” solution. The choices are as follows:

Invest billions of dollars into R&D and reallocate their engineering teams to focus on catching up in the battery technology race. The largest companies may have the capital, but they do not have the patents and no matter how much money a company may have, you cannot rush development of a reinvented technology. R&D would require both (i) additional hiring and (ii) internal shuffling of labor capital to focus on battery R&D. By reallocating engineers to the R&D effort, companies will be left with gaps within their other segments that also require engineering R&D to maintain their market share.

Enter into a selling agreement with a company like ENVX, where the OEM would then rely on Enovix to produce the batteries that would then be used in the OEM’s consumer products. The dollar value that would be assigned to this choice varies depending on the OEM, but I believe this is the “least bad” option for management teams as they can buy themselves time in developing their own technology.

Moreover, OEMs are also faced with having to enter the commodities markets for the metal components that make up the batteries they are looking to develop, which creates upward pressure on metal prices, steepening the cost of R&D even further. Yes, OEMs are in metals markets today, but in order to effectively research & develop the technology further, OEMs will need to increase the amount they are purchasing in a market where they are price takers, not price makers. Bloomberg has a great article on this here.

Investment Thesis

Market Solution

The dilemma outlined above is extremely bullish for Enovix, who holds the solution for OEMs. As mentioned, I believe the least unfavorable option is for these companies to enter into a selling agreement with ENVX to preserve their market share. Yes, such an agreement would likely compress margins for companies like Apple, Google, Tesla, etc., but it would also enable them to maintain their status as market leaders.

Moreover, it would not be surprising to see a selling agreement paired with a joint venture to increase production capacity to meet the demand requirements that these massive OEMs have. In reality, if Enovix were to partner with an Apple or Tesla, both ENVX and the JV company would benefit greatly. Enovix would receive the scale while the OEM would pay for a percentage of what it would cost to buy the batteries directly. This scenario poses a strategic decision for ENVX: opt into a JV and increase their market share quickly or continue to work methodically to capture market share organically. If the history of TJ Rodgers, Enovix’s Chairman, is any indication, the approach will likely be the latter.

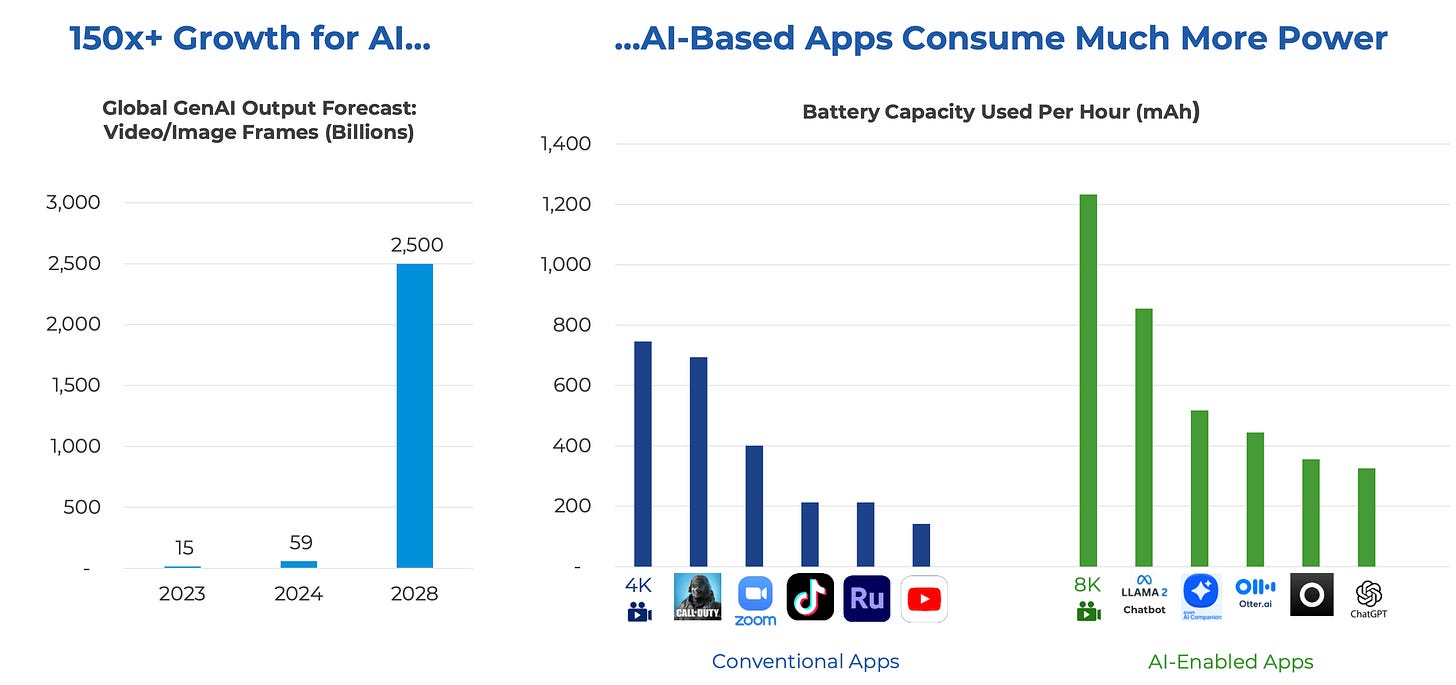

Enovix’s products are indispensable for OEMs, not a luxury. As technology continues to advance and software becomes more complex, batteries must evolve to support the compute power required to power these advancements. Look no further than the chart comparing the battery capacity required for conventional apps compared to AI-enabled apps:

What do you notice? I see a massive void in the market for batteries that not only can sufficiently power these products, but can also operate at full capacity while withstanding rigorous cycling.

Valuation

At the current Enterprise Value of $1.21bn, ENVX is trading at an almost identical EV to when the company went public via SPAC at a $1.13bn valuation in July, 2021. Yet, the company is now almost 3 years further along, producing batteries on a commercial scale, and has built out 250,000 sq. feet of additional factory space in Malaysia for their Fab-2 production facility.

From a balance sheet perspective, ENVX held a current ratio of 5.3x as of 12/31/23 with cash, cash equivalents and short-term investments totaling $308.8mm and Total Current Assets equal to $323.2mm. Additional company assets brings Total Assets to $564.3mm.

Conversely, ENVX’s liabilities are de minimus relative to assets with Total Current Liabilities equaling $61.0mm, while Total Liabilities were $303.2mm. Of the $303mm in Total Liabilities, ENVX long-term debt is $169.1mm with 96% of that debt carrying an average interest rate of 3%. So not only does ENVX have ample cash to cover all debt obligations, but they are currently earning ~2.5x in interest income compared to the interest their debt is accruing.

I focus on the balance sheet because ENVX is a growth company. A growth company’s ability to maintain a healthy balance sheet has a direct relationship on its future prospects and Enovix’s balance sheet is as bullet proof as one gets for a growth company of this scale.

Top-Tier Leadership

Under the leadership of CEO Dr. Raj Talluri and a team comprising other key executives like TJ Rodgers (Executive Chairman of the Board), Ajay Marathe (Chief Operating Officer), and Bernard Guttman (Director), Enovix is poised to succeed as pioneers in the evolving battery market. The company’s focus on silicon-anode technology is a response to the increasing demand for batteries that offer higher efficiency and longer life spans than traditional lithium-ion batteries. This is no small feat, which is why leadership in a company like Enovix is of the utmost importance.

The company's current president and CEO Mr. Raj Talluri was chosen by the legendary T.J. Rodgers. Rodgers, who led the SPAC that took ENVX public, is most known for co-founding Cypress Semiconductor. Rodgers served as Cypress’ CEO for 34 years until stepping down in 2016 as the longest-tenured CEO among all publicly-traded technology companies.

Rodgers has served as member of Enovix’s board since 2012 and currently serves as Chairman of the Board.

Conclusion

Enovix Corp. (ENVX) is a battery technology design and manufacturing business that is showcasing significant potential for shifting the current market share in their favor. This feat is not for the faint of heart, but with the leadership team that Enovix has assembled, I see this as more probable than not.

Although this piece is only a brief overview, it should serve as a strong foundation for further research. For those interested, I have an additional 8,000+ word report that gets into the nuances of the business.

I have also provided links from Enovix’s Q4 2023 quarterly results below. I highly recommend looking through the investor presentation because Enovix does a phenomenal job explaining highly technical aspects in an understandable way

1. Enovix Investor Presentation – Q4 2023

2. Enovix Letter to Shareholders – Q4 2023

Disclosure: The information provided in this report is for informational purposes only and should not be interpreted as financial advice. It represents the opinions of the authors based on their analysis at the time of writing and is subject to change without notice. We recommend consulting with a qualified financial advisor before making any investment decisions based on this report.

Damn! This is so refreshing! Awesome research. I’m in big and not everyone gets this company to this extent. I find it very rare. Great job!!! Thank you

good note.