What does Animal Health and Coach Doug Pederson Have in Common?

Good Luck, God Bless, and Go Birds, Baby!

Confusing title, right? It’ll make sense once you read below.

I think one of the most important qualities an investor can have is curiosity. Curious people are always searching for new ideas, asking questions and focused on the future for any signs that the norm is soon to be upended. I think those who are curious make the world a more interesting place because complacency is never an option. They are always striving for more - something I pride myself on. I believe my knack for being curious is one of my greatest strengths as an investor, it’s the thing that drives me to turn over every stone so that I can make the most informed investment decisions that I can. This game we play is not for the faint of heart, it will beat you down and when you finally think you have it figured out, it will evolve, leaving you in the place you started.

For those who know me personally, know that not only am I willing to talk to anyone about anything, they expect it. Being extroverted is a trait, sure, but the real reason I’ll talk to anyone who can help me be a more informed investor is actually because of my stubbornness. If I want something and haven’t been able to find the answer for the problem I’m trying to solve, I’m relentless - sometimes to a fault. This is also why I am naturally inclined to be a short seller. Management teams that provide non-answers or refuse to acknowledge reality are my favorite because what they don’t know is that they just let me off my leash. I love the chase, sniffing out whatever it is they don’t want the market to know. Maybe I love it too much, but that’s a piece for another day.

Unlike what I just said about loving shorts, today I present you with a pair of long positions to consider for your portfolio. The first is listed in this article and the second will be highlighted in a separate piece.

This week I got the news that my dog, Coach Dog Pederson (Coach, for short), needed to get surgery on his CCL – the dog equivalent of a human ACL.

When I got the news from the vet, I was given a few options for treatment, but the only way to fix his injury entirely was to repair the CCL with surgery followed by 8 weeks of rest and rehab. Even though I was given other options, I hardly hesitated to move forward with their suggestion of having surgery on his knee. Coach is 5 years old and has a lot more running around to do and holes to dig in this lifetime so surgery it was.

Shortly after making the call to schedule Coach’s surgery, something strange happened. I swore I heard the faint thumping of war drums beating in the distance, representing a declaration of war, but why? Turns out that I was hearing my inner voice screaming in agony at the idea of spending the next few weeks fighting with Coach’s insurance company to pay for the surgery.

Immediately after the inner yelling stopped, next came the negotiations with God, where I promised to never commit another sin for the rest of my life if he made the insurance claim process relatively painless.

After that, my curiosity got the best of me and before I knew it, I was deep down a wormhole reading about publicly traded companies that deal in the animal health industry. That’s why you’re here, right? To read about what I learned and what piqued my interest? Let’s get into it.

Animal Health Companies

The company I am focused on today is Zoetis (ZTS).

Company Description

Zoetis is a global leader in the animal health industry, focused on the discovery, development, manufacture and commercialization of medicines, vaccines, diagnostic products and services, biodevices, genetic tests and precision animal health. ZTS has a diversified business, commercializing products across 8 core species:

Companion Category: Dogs and cats

Livestock Category: Horses, cattle, swine, poultry, fish and sheep

The company also serves 7 major product categories: parasiticides, vaccines, dermatology, other pharmaceutical, anti-infectives, animal health diagnostics and medicated feed additives. The company was founded in 1952, but has been trading as a public company since February 2013 when it was rolled out of Pfizer’s Animal Health division. Zoetis is headquartered in Parsippany, New Jersey.

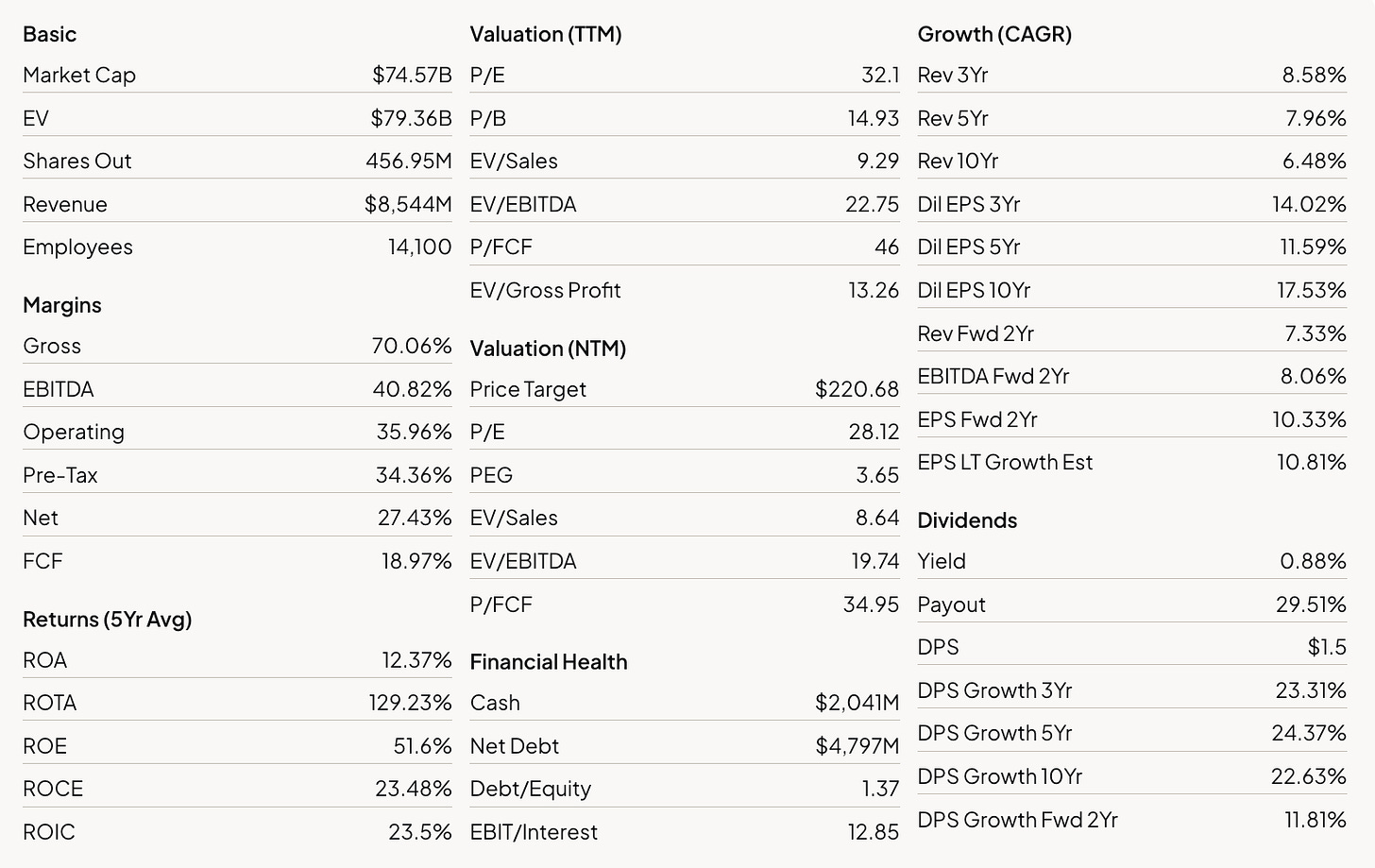

ZTS Financial Overview from FinChat.io is listed below:

My Thoughts

Zoetis has been a name I’ve been familiar with for years and falls in my “own forever” bucket. The company is run by an exceptional management team that I believe has done a great job at focus on running the business rather than only focusing on the company’s stock price. Although I shouldn’t have to say this, there are more businesses that have boards and management teams that focus on stock price rather than their core business. The irony is that if a company’s leaders focus solely on the business, the stock price will reflect that. From my perspective, Zoetis’ board and management team seem hell-bent on creating the best business they can and the results of that focus are evident. In fact, one of the company’s core mottos is “Customer Obsessed”. As an investor and a consumer, I love that. It’s safe to say other consumers also love what Zoetis provides, just take a look at their revenue and profit margin for the last 10 years:

10-year Revenue CAGR of 6.7% and Profit CAGR or 9.4%? I need more companies like this in my life, investing would be a whole hell of a lot easier.

Zoetis has a presence in over 100 countries globally and is the global leader of Animal Health products in North America, Latin America and Asia, while also being second globally in Eastern and Western Europe. The company has approximately 300 product lines on the market today and 15 of those products have earned over $100mm in revenue individually.

In short, Zoetis is not going anywhere and they are in phenomenal shape financially. As of the end of Q4 2023, ZTS had more unrestricted cash on hand than they do current liabilities while also running a +27% profit margin. What’s even more mind-boggling is ZTS’ having averaged Return on Equity (ROE) of 51.6% (!) over the last 5-years.

Analyst Estimates - 2024

Revenue: $9.184bn (+7.5% YoY)

EPS: $5.79/Share (+8.8% YoY)

Dividend Growth: +10.1% to $1.728/Share Annually

The beautiful thing about markets is that you can bet on multiple horses rather than placing all of your eggs in one basket. As much as I love Zoetis, I also love their primary competitor IDEXX Laboratories (IDXX).

As the greatest racing duo in history, Ricky Bobby and Cal Naughton Jr., once said, “Shake and Bake!” I’m all about shaking and baking, so with that being said, I’ll be publishing a follow-up piece highlighting IDXX and what they bring to the table.

As for Coach Doug Pederson’s relation to this - not much besides being my dog’s namesake, but it never hurts to say Good Luck, God Bless, and Go Birds, baby!