“It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena.” - Theodore Roosevelt

-Tom Hogan

If that quote seems familiar to you, that’s because it is the same quote I used in my March piece titled, "Making the Case for Enovix (ENVX)”. I also want to point out that I think it’s safe to say that I’ve made the quote more famous than Teddy Roosevelt did, sort of like Michael Scott helping Wayne Gretzky out.

What’s not up for debate is the meaning behind the quote - putting your work out into the public domain makes you the Man in the Arena. As the Man in the Arena, you are at the mercy of the market, which will tell you if you are right or wrong in no uncertain terms. Today, the market voted in favor of my Enovix thesis following the company’s blowout Q1 earnings. Before we get into the numbers, I have to say that just because I was right today, does not mean I will be right tomorrow and all of us, as investors, must be egoless in markets in order to succeed over the long term.

Enovix Q1 Results

Revenue: $4.05mm estimate versus $5.27mm actual - Beat

Also came in higher than Management’s Q1 Guidance of $3.5mm - $4.5mm

Net Loss: ($49.17mm) estimate versus ($46.37mm) actual - Beat

EPS: ($0.35)/Share estimate versus ($0.28)/Share actual - Beat

Q2 Guidance

Revenue: $3mm - $4mm

Adj. EBITDA: ($26mm) - ($32mm)

Non-GAAP EPS: ($0.22)/Share - ($0.28)/Share

As a result of ENVX’s blowout earnings, the stock is trading up +45% to $9.44/Share as of 3:30pm. When I wrote about ENVX on March 15th, stock was $7.76/Share which gives it a theoretical return of +21.6%.

Rather than wait for the question to be asked, I’ll answer it now: Yes, I think ENVX has more room to run in the short-term. A daily return of 45% is quite unusual, but I don’t think the short term move is over due to a few factors:

Management’s guidance seems to always be conservative in nature, while their operating prowess is much higher than what they guide to.

The stock has over 30% short interest as of April 15th, which is the most recent published settlement date. For those interested, you can find the Short Interest Schedule Here.

Q1 Management Highlights

Stronger revenues and favorable product mixed helped the company achieve positive non-GAAP gross margins for the first time in the company’s history.

Malaysia Factor Buildout: Factory Acceptance Testing (“FAT”) is complete for Enovix’s Gen-2 Agility Line and ‘nearly complete’ for the company’s Gen-2 Autoline. Site Acceptance Training (“SAT”) is well underway for both the Gen-2 Agility and Autolines.

What does this mean? It means that the company’s breakthrough EX-1M li-ion battery will be actively producing samples in Q2 and producing capacity will increase to meet customer demands.

Company also slid a note into the Shareholder Letter noting that in April the company produced its first internal sample of the EX-1M smartphone battery at its Fab1 facility.

Cash Burn Efficiency: Management noted that they are targeting a 33% reduction In fixed costs cash burn, which is equivalent to $35mm+ in savings annually. Management wants to complete this goal by the end of FY24.

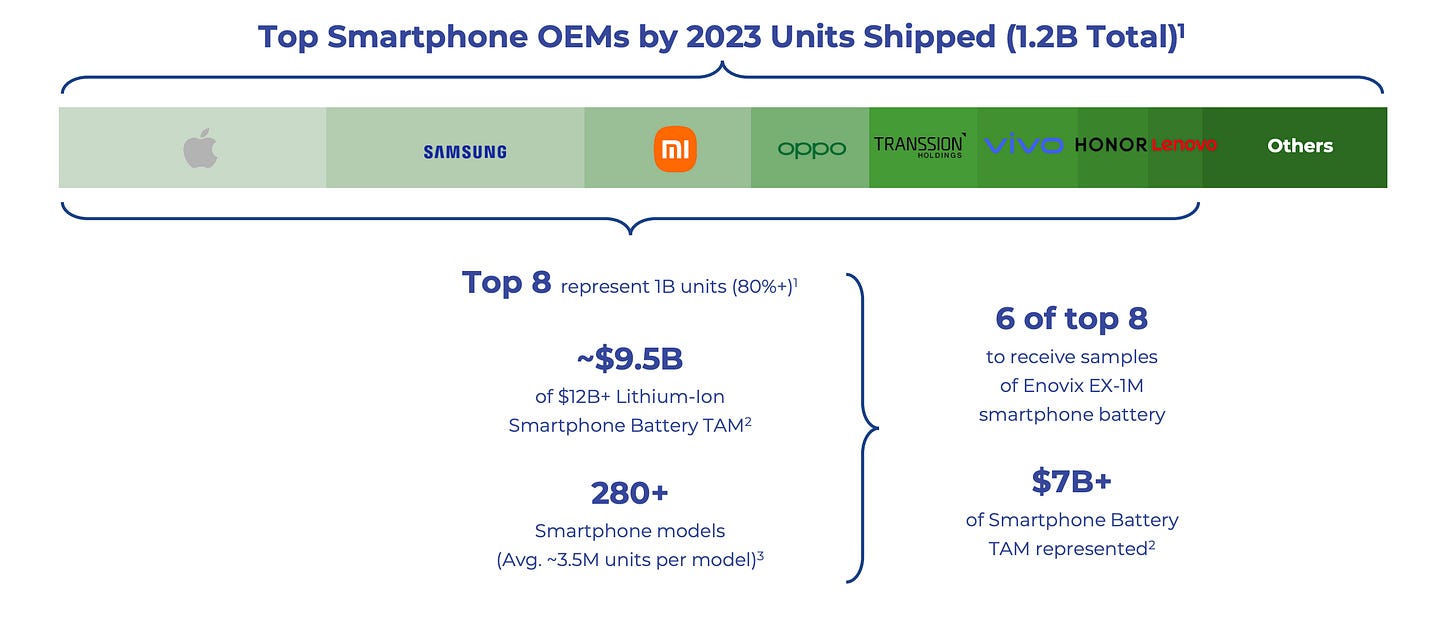

New Customer Agreements: Signed a development agreement with a “top 5 smartphone OEM by unit volume”. This means Enovix has signed a development agreement with one of the following smartphone OEMs: Apple, Samsung, Xiaomi/Huawei, Oppo, or Transsion.

This news also means that Enovix will be providing 6 of the 8 largest Smartphone OEMs with samples of the company’s EX-1M smartphone battery. Image below from the company’s Q1 Investor Presentation.

So, not only on the surface were results great, the details of the results were even more exciting. As a result of these earnings, I thought it would be beneficial to revisit the summary from my previous piece. My goal is to always create value for readers and the only way to do that is revisiting what I thought before to see what was correct, wrong and what has changed.

For those interested in learning about ENVX, I encourage you to read the piece in its entirety, but for the sake of this article, the summary is listed below":

Enovix (ENVX) continues to beat analyst estimates through exceptional operational efficiency. As the company maintains guidance heading into FY 2025, I believe Enovix will continue to de-risk by increasing its production ramp and addressing end-market demand constraints. This de-risking process is expected to continue as equipment testing at the Malaysia-based Fab-2 facility progresses in a timely manner. Furthermore, Fab-2 production is anticipated to begin production in the second half of 2024, with initial factory yields of approximately 60% once production starts, before ramping to ~90% in the second half of 2025. Once production starts at the Fab-2 facility, the company will be able to increase the pace of Fab-1 repurposing while also improving input costs. Additionally, Enovix continues to experience growth in its testing pipeline with the inclusion of more auto OEM test cases. The ongoing tests with OEMs, coupled with the company’s existing contracts, underscores the strong market demand for Enovix products across various sectors.

Reasons I am bullish:

Superior management team and Board of Directors.

Cutting-edge technology with differentiating factors that have created a multi-year competitive advantage over peers and significant market demand for Enovix products.

Asymmetric risk-reward profile, given market dynamics and company valuation

My perspective on ENVX is distinct from other investments I consider because I view ENVX as a long-term investment, one I can feasibly see holding for 5+ years barring significant shifts in operational efficiency and/or poor capital allocation by management. It’s challenging to find opportunities that present a risk-reward profile that is as favorable as ENVX’s. Having followed the company since it went public via SPAC in July 2021, I am confident in my analysis and believe that ENVX will be a cornerstone of my portfolio for the foreseeable future. As a mid-cap company, I anticipate price volatility, but I also welcome it, as volatility will allow me to add to my position when the stock sells off.

Points of Focus from Previous Piece

“I believe Enovix will continue to de-risk by increasing its production ramp and addressing end-market demand constraints.”

Notes: This was a correct assumption. Enovix significantly de-risked its production ramp by continuing to move forward with both FAT and SAT goals being met. This continuation of operational efficiency is critical for future results.

“Cutting-edge technology with differentiating factors that have created a multi-year competitive advantage over peers and significant market demand for Enovix products.”

Notes: This may be inside baseball, but management’s comments about producing internal samples of the EX-1M smartphone battery at the company’s Fab1 facility is proof of their operational effectiveness. The company was never expected to be able to create these samples at their Fab1 facility, but they did. Now that Fab2 is moving forward in Malaysia, the market will have to expect production capacity to expand beyond original expectations.

“Asymmetric risk-reward profile, given market dynamics and company valuation”

Notes: Correct assumption especially given market dynamics with the stock carrying a 30% short interest. Shorts will be forced to cover as their margin requirements and interest rates of the trade will increase due to heightened volatility in the stock’s price action. I expect the stock to settle higher over the coming months barring some unforeseen announcements.

To finish, I wanted to leave you all with the updated financial summary of ENVX courtesy of Finchat.io:

So with that summary, I bid you adieu. Looking forward to and hoping for a great quarter from BLDE next week on May 7th, which I will also follow up on.

For those who would like to discuss ENVX further, please feel free to reach out.